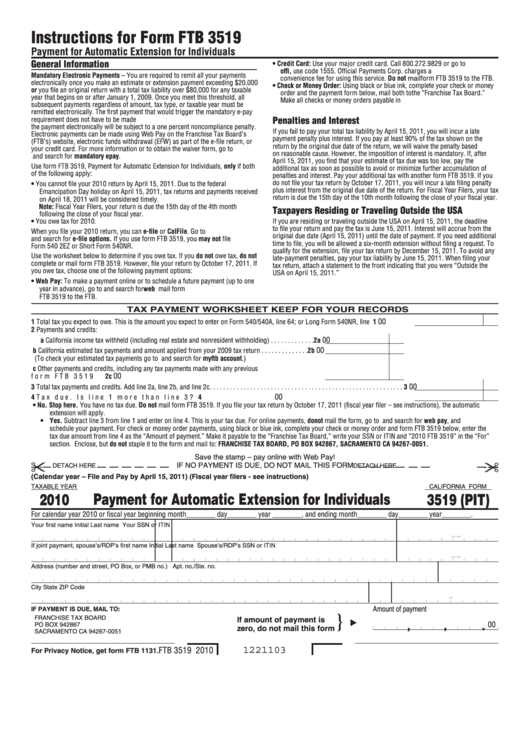

You cannot file your 2022 tax return, Form 540 or Form 540NR, byĪpril 18, 2023.Use form FTB 3519, Payment for Automatic Extension for Individuals, For more information or to obtain the waiver form, go to Electronic payments canīe made using Web Pay on the Franchise Tax Board’s (FTB’s) website,Įlectronic funds withdrawal (EFW) as part of the e-file tax return, or yourĬredit card. Will be subject to a 1% noncompliance penalty. Individuals who do not send the payment electronically Would trigger the mandatory e-pay requirement does not have to be madeĮlectronically. Or taxable year must be remitted electronically. This threshold, all subsequent payments regardless of amount, tax type, Original tax return with a total tax liability over $80,000. You are required to remit all your payments electronically once you makeĪn estimate or extension payment exceeding $20,000 or you file an

0 kommentar(er)

0 kommentar(er)